Passion Investments & NFTs

By Anya Cooklin-Lofting

For many, investments of passion are a welcome balm to the complexities and intangibilities of more traditional investment categories like stocks and bonds. At their most basic, passion investments involve the purchase of items you love that tend to be defined by their rarity, quality, cultural or aesthetic value and of course, their demand. It is all about investing in alternative kinds of assets that bring you more than just a return on your investment should you choose to sell. In other words, such investments offer investors the chance to enjoy the items under their care.

Typical passion investments include art and furniture, jewellery, coins and cars, which generally demonstrate an increase in value over time, or at least tend to hold their value. Because passion investors aren’t guaranteed a return, it’s important to look at how different passion investment categories have performed over the last couple of decades to help inform their purchases. However, investments of passion do tend to perform well during periods of economic uncertainty because the value of passion asset classes doesn’t undulate with the rise and fall of potentially unfavourable stock markets. In this way, passion investing proves to be a sensible, enjoyable and rewarding way to diversify your investment portfolio.

The best part about investing, and investing in passion asset classes more specifically, is that you don’t have to be an ultra-high net worth individual to get involved. While there are some categories that demand a certain amount of wealth due to the nature of the assets (such as classic cars), the majority offer entry-level investment opportunities for every budget.

Fine art is the best example of a passion investment that feels at once democratic and exclusive depending on the financial commitment you’re happy to make. Although there is no guarantee that your investment will pay off, you’ll be able to enjoy the art while you own it and bide your time while tastes and demands fluctuate.

The same principles can be applied to antique and designer furniture or jewellery. Our collective, quickly changing tastes and preferences adversely affect the valuation of these kinds of assets. The best thing to do over and above enjoying your purchases is to keep them safe, clean and out of direct sunlight.

The more progressive, experimental set of passion investors, however, are turning to other asset classes. Designer trainers, for example, have come into their own as an investment category, hence the £22,783 price tag attached to the Kanye West X Louis Vuitton collection. But one of the most headline-grabbing passion investment options is in Non-Fungible Tokens or NFTs, which allow passion investors to own digital assets.

In the midst of the pandemic in March 2021, market tracking revealed a collective spend of US$200 million on NFTs including artworks, memes and gifs. Fundamentally, an NFT is a non-interchangeable, non-replicable asset, making it more similar to a piece of art in the physical world than the cryptocurrency one would use to buy it.

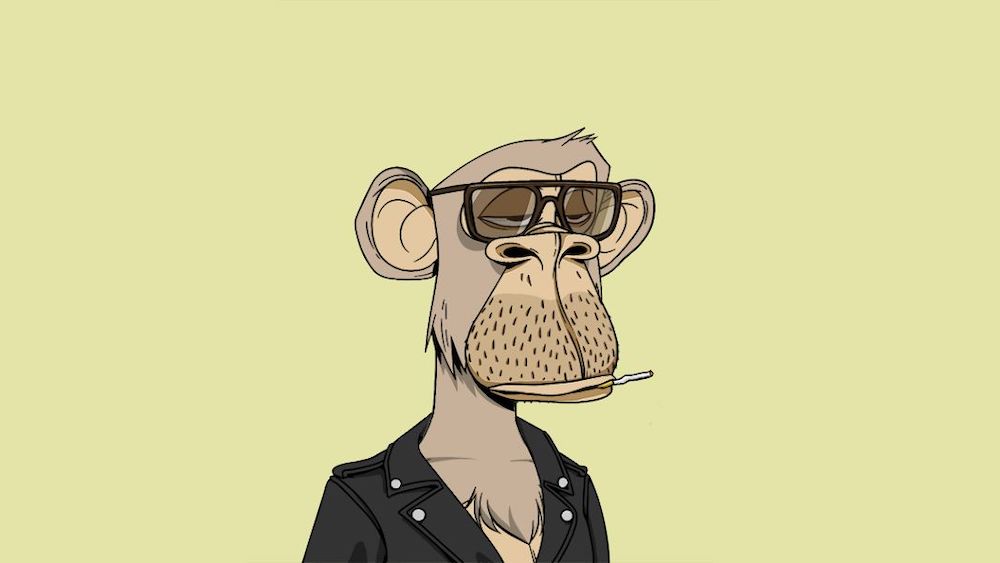

This is well summarised the popularity of ‘Bored Ape’ NFTs, a limited edition of 10,000 artworks with different unique traits and qualities, owned largely by super-rich musicians and sports personalities and created by the application software developer, Yuga Labs. The very human act of art-buying is driven by aesthetics; we buy the art that speaks to us, and this is also how passion investors pursue their NFTs, and Bored Apes in particular. But on a wider, slightly more psycho-sociological level, Yuga Labs has created a brand-led community in the same way that other luxury brands have done, giving wealthy participants in the community a sense of belonging and prestige. They have successfully built a digital community that uses a heady cocktail of ‘hype’ (as celebrities publically invest in their NFTs) and new technology to charm an audience and persuade people into passion investments that serve to express their digital identities.

In the same way a passion investor in physical fine art might collect works from a narrow artistic movement, era or style to say something about who they are in the world, NFT investors are investing in works that inform their digital presence. All of us with any disposable income have those things in our lives that feel like part of the collage of ‘stuff’ that makes up our curated personalities. NFTs are just an extension of that phenomenon but in the digital world.